2018 INCENTIVE COMPENSATION PLAN

ARTICLE I

PURPOSE

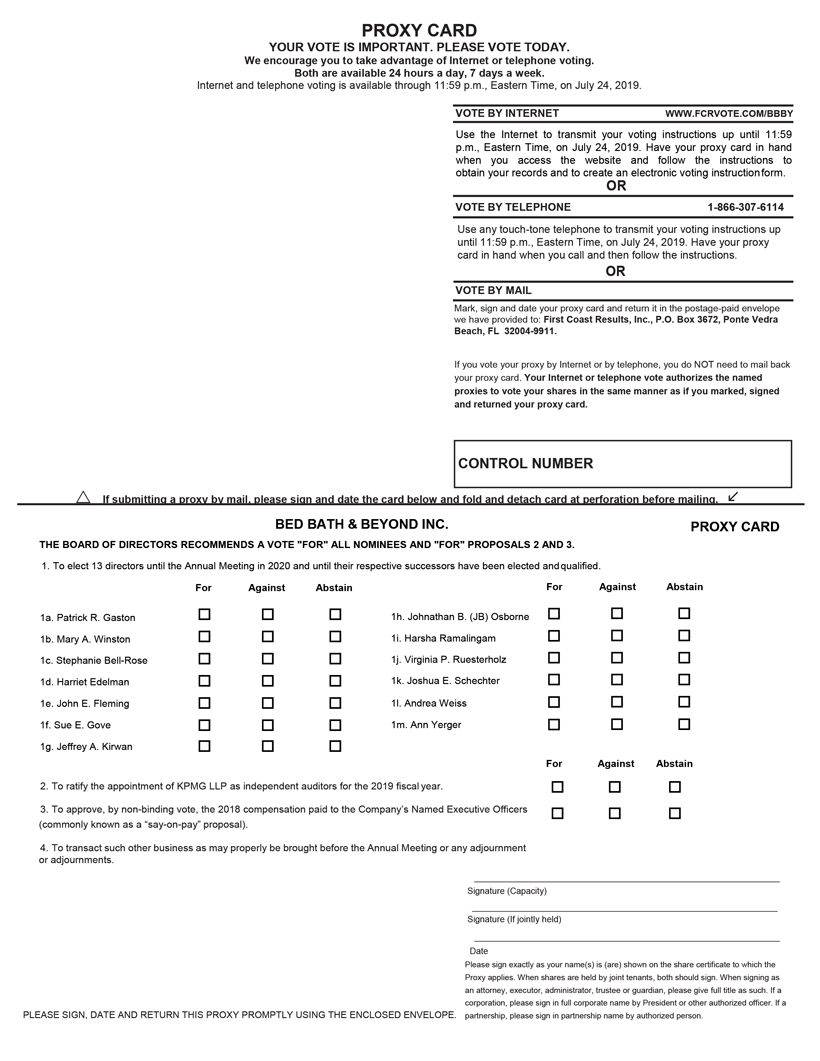

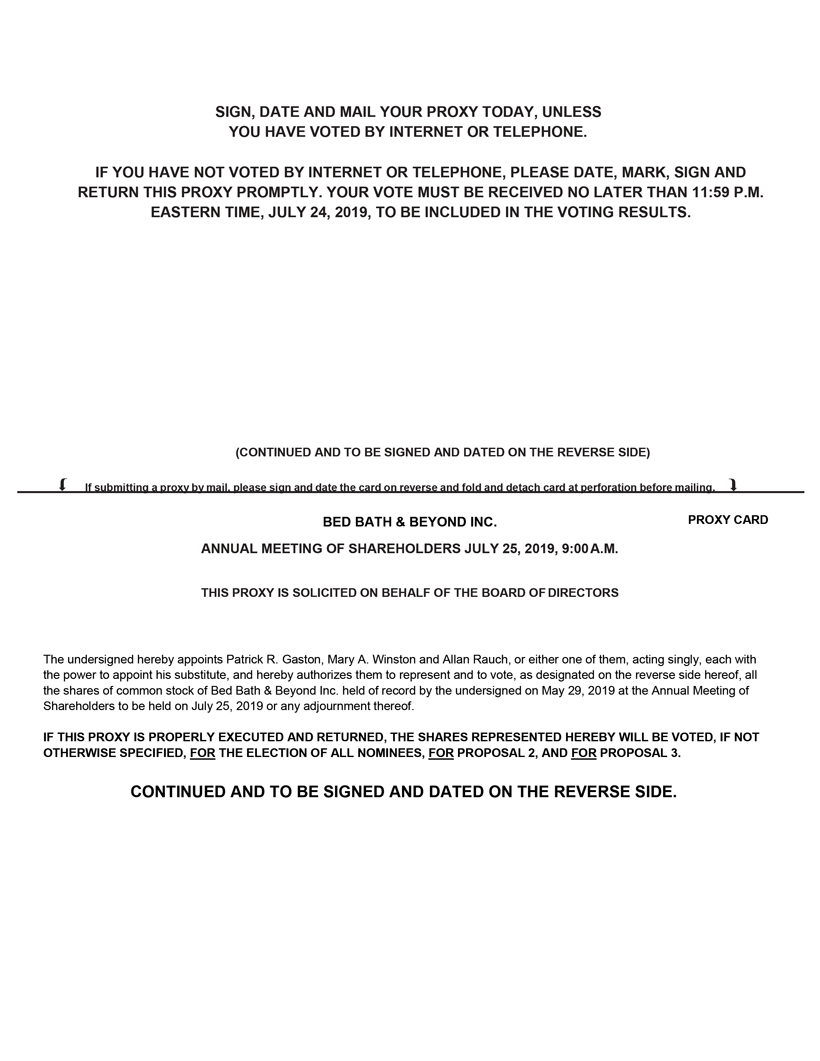

SIGN, DATE AND MAIL YOUR PROXY TODAY, UNLESS YOU HAVE VOTED BY INTERNET OR TELEPHONE. IF YOU HAVE NOT VOTED BY INTERNET OR TELEPHONE, PLEASE DATE, MARK, SIGN AND RETURN THIS PROXY PROMPTLY. YOUR VOTE MUST BE RECEIVED NO LATER THAN 11:59 P.M. EASTERN TIME, JULY 24, 2019, TO BE INCLUDED IN THE VOTING RESULTS. (CONTINUED AND TO BE SIGNED AND DATED ON THE REVERSE SIDE) If submitting a proxy by mail, please sign and date the card on reverse and fold and detach card at perforation before mailing. BED BATH & BEYOND INC. ANNUAL MEETING OF SHAREHOLDERS JULY 25, 2019, 9:00 A.M. PROXY CARD THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS The purposeundersigned hereby appoints Patrick R. Gaston, Mary A. Winston and Allan Rauch, or either one of thisthem, acting singly, each with the power to appoint his substitute, and hereby authorizes them to represent and to vote, as designated on the reverse side hereof, all the shares of common stock of Bed Bath & Beyond Inc. 2018 Incentive Compensation Plan is to enhance the profitability and valueheld of the Company for the benefit of its shareholders by enabling the Company to offer Eligible Employees, Consultants and Non-Employee Directors stock-based and other incentives, thereby creating a means to raise the level of equity ownership by such individuals and provide other incentives in order to attract, retain and reward such individuals and strengthen the mutuality of interests between such individuals and the Company’s shareholders.

The Plan was adoptedrecord by the Boardundersigned on May 22, 2018, as29, 2019 at the Bed Bath & Beyond Inc. 2018 Incentive Compensation Plan, effective upon the date the shareholdersAnnual Meeting of the Company approve the Plan in accordance with the laws of the State of New York and the requirements of the Nasdaq Stock Market.

ARTICLE II

DEFINITIONS

For purposes of the Plan, the following terms shall have the following meanings:

2.1 “Acquisition Event” has the meaning set forth in Section 4.2(d).

2.2 “Affiliate” means each of the following: (a) any Subsidiary; (b) any Parent; (c) any corporation, trade or business (including, without limitation, a partnership or limited liability company) that is directly or indirectly controlled 50% or more (whether by ownership of stock, assets or an equivalent ownership interest or voting interest) by the Company or one of its Affiliates; (d) any corporation, trade or business (including, without limitation, a partnership or limited liability company) that directly or indirectly controls 50% or more (whether by ownership of stock, assets or an equivalent ownership interest or voting interest) of the Company; and (e) any other entity in which the CompanyShareholders to be held on July 25, 2019 or any of its Affiliates has a material equity interest and that is designated as an “Affiliate” by resolution of the Committee.

2.3 “Award” means any award under the Plan of any Option, Stock Appreciation Right, Restricted Stock Award, Performance Award or Other Stock-Based Award.

2.4 “Board” means the Board of Directors of the Company.

2.5 “Cause” means with respect to a Participant’s Termination of Employment or Termination of Consultancy, the following: (a) in the case where there is an employment agreement, consulting agreement, change in control agreement or similar agreement in effect between the Company or an Affiliate and the Participant at the time of the grant of the Award that defines “cause” (or words or a concept of like import), “cause” as defined under such agreement; provided, however, that with regard to any agreement under which the definition of “cause” applies only on occurrence of a change in control, such definition of “cause” shall not apply until a change in control actually takes place and then only with regard to a termination in connection therewith; or (b) in the case where there is no employment agreement, consulting agreement, change in control agreement or similar agreement in effect between the Company or an Affiliate and the Participant at the time of the grant of the Award (or where there is such an agreement but it does not define “cause” (or words or a concept of like import)), termination due to a Participant’s insubordination, dishonesty, fraud, incompetence, moral turpitude, willful misconduct, refusal to perform his or her duties or responsibilities for any reason other than illness or incapacity or materially unsatisfactory performance of his or her duties for the Company or an Affiliate, as determined by the Committee in its sole discretion. With respect to a Participant’s Termination of Directorship, “cause” means an act or failure to act that constitutes cause for removal of a director under applicable New York law.

2.6 “Change in Control”means, the occurrence of any one or more of the following events:

(a) any “person” as such term is used in Sections 13(d) and 14(d) of the Exchange Act (other than the Company, any trustee or other fiduciary holding securities under any employee benefit plan of the Company, or any company owned, directly or indirectly, by the shareholders of the Company in substantially the same proportions as their ownership of Common Stock of the Company), becoming the beneficial owner (as defined in Rule 13d-3 under the Exchange Act), directly or indirectly, of

adjournment thereof. IF THIS PROXY IS PROPERLY EXECUTED AND RETURNED, THE SHARES REPRESENTED HEREBY WILL BE VOTED, IF NOT OTHERWISE SPECIFIED, FOR THE ELECTION OF ALL NOMINEES, FOR PROPOSAL 2, AND FOR PROPOSAL 3. CONTINUED AND TO BE SIGNED AND DATED ON THE REVERSE SIDE.

securities of the Company representing more than fifty percent (50%) of the combined voting power of the Company’s then outstanding securities, excluding a person that is an “affiliate” (as such term is used in the Exchange Act) of the Company on the date of this Agreement, or any affiliate of any such person;

(b) during any period of twelve (12) months, the majority of the Board consists of individuals other than “Incumbent Directors” which term means the members of the Board at the beginning of such period, and any new director (other than a director designated by a person who has entered into an agreement with the Company to effect a transaction described in subsections (a), (c), or (d) or a director whose initial assumption of office occurs as a result of either an actual or threatened election contest (as such term is used in Rule 14a-11 of Regulation 14A promulgated under the Exchange Act) or other actual or threatened solicitation of proxies or consents by or on behalf of a person other than the Board) whose election by the Board or nomination for election by the Company’s shareholders was approved by a vote of a majority of the directors who comprised the Incumbent Directors or whose election or nomination for election was previously so approved;

(c) upon the consummation of a merger or consolidation of the Company with any other corporation, other than a merger or consolidation which would result in the voting securities of the Company outstanding immediately prior thereto continuing to represent (either by remaining outstanding or by being converted into voting securities of the surviving entity) fifty percent (50%) or more of the combined voting power of the voting securities of the Company or such surviving entity outstanding immediately after such merger or consolidation; provided, however, that a merger or consolidation effected to implement a recapitalization of the Company (or similar transaction) in which no person (other than those covered by the exceptions in (a) above) acquires more than fifty percent (50%) of the combined voting power of the Company’s then outstanding securities shall not constitute a Change in Control of the Company;

(d) upon approval by the shareholders of the Company, the Company adopts any plan of liquidation providing for the distribution of all or substantially all its assets, provided that this Section 2.6(d) shall not constitute a Change in Control with respect to a 409A Covered Award; or

(e) upon the consummation of a sale or disposition by the Company of all or substantially all of the Company’s assets other than the sale or disposition of all or substantially all of the assets of the Company to a person or persons who beneficially own, directly or indirectly, at least fifty percent (50%) or more of the combined voting power of the then outstanding voting securities of the Company at the time of the sale.

Notwithstanding the foregoing, for an Award that provides for payment or settlement upon a Change in Control and that constitutes a 409A Covered Award, a transaction will not be deemed a Change in Control unless the transaction qualifies as a change in control event within the meaning of Section 409A of the Code.

Further and for the avoidance of doubt, a transaction will not constitute a Change in Control if: (i) its sole purpose is to change the state of the Company’s incorporation, or (ii) its sole purpose is to create a holding company that will be owned in substantially the same proportions by the persons who held the Company’s securities immediately before such transaction.

2.7 “Code” means the Internal Revenue Code of 1986, as amended. Any reference to any section of the Code shall also be a reference to any successor provision and any Treasury Regulation promulgated thereunder.

2.8 “Committee” means: (a) with respect to the application of the Plan to Eligible Employees and Consultants, the Compensation Committee of the Board appointed from time to time by the Board (or another committee or committees of the Board appointed for the purposes of administering the Plan); and (b) with respect to the application of the Plan to Non-Employee Directors, the Board. In the event that more than one Committee is appointed by the Board, the Board shall specify with respect to each Committee the group of Persons with respect to which such Committee shall have the power to grant Awards. In the event that more than one Committee is appointed by the Board, then each reference in the Plan to “the Committee” shall be deemed a reference to each such Committee (subject to the last sentence of this paragraph); provided, however, that each such Committee may exercise only the power and authority granted to “the Committee” by the Plan with respect to those Persons to which it has the power to grant Awards as specified in the resolution of the Board appointing such Committee. Each Committee shall be comprised of two or more Directors. Each Committee shall consist of two or more non-employee directors, each of whom is intended to be a “non-employee director” as defined in Rule 16b-3 promulgated under Section 16(b) of the Exchange Act, an “independent director” as defined and to the extent required under the rules and regulations of the Nasdaq Stock Market or such other applicable securities exchange upon which the Common Stock is then listed or any national securities exchange system upon whose system the Common Stock is then quoted, and, as may be applicable, “independent” as provided pursuant to rules promulgated by the Securities and Exchange Commission under The Dodd-Frank Wall Street Reform and Consumer Protection Act; provided, however, that to the extent allowed by applicable law, the foregoing shall not apply to any Committee that does not have the power to grant Awards to executive officers or Directors of the Company or otherwise make any decisions with respect to the timing or the pricing of any Awards granted to such executive officers and Directors. If for any reason such Committee does not meet the requirements of Rule 16b-3, such

noncompliance with the requirements of Rule 16b-3 shall not affect the validity of Awards, grants, interpretations or other actions of the Committee. In the event that more than one Committee is appointed by the Board, the power to amend the Plan granted by Article XI hereof may be exercised only by a Committee comprised solely of “non-employee directors” within the meaning of Rule 16(b)-3 under the Exchange Act or by a majority or the entire Board.

2.9 “Common Stock” means the Common Stock, $0.01 par value per share, of the Company.

2.10 “Company” means Bed Bath & Beyond Inc., a New York corporation, and its successors by operation of law.

2.11 “Consultant” means any individual who (either directly or through his or her employer) is an advisor or consultant to, or subject to Section 5.2, a prospective advisor or consultant to, the Company or an Affiliate.

2.12 “Director” means a member of the Board of Directors of the Company (or any successor to the Company).

2.13 “Disability” shall mean, unless otherwise determined by the Committee at grant, a Participant’s “disability” (or term of like import) as such term is defined in the long-term disability plan of the Company applicable to such Participant or, in the absence of such a definition, the inability of a Participant to perform the major duties of his or her occupation for at least 90 days in any 180-day period because of sickness or injury. Notwithstanding the foregoing, for Awards under the Plan that provide for payments that are triggered upon a Disability and that constitute “non-qualified deferred compensation” pursuant to Section 409A of the Code, Disability shall mean that a Participant is disabled under Section 409A(a)(2)(C)(i) of the Code.

2.14 “Effective Date” means the effective date of the Plan as defined in Article XIV.

2.15 “Eligible Employee” means each employee of, or subject to Section 5.2, each prospective employee of, the Company or an Affiliate. Notwithstanding the foregoing, with respect to the grant of Incentive Stock Options, Eligible Employees shall mean each employee of the Company, its Subsidiaries or its Parents, if any, other than a prospective employee, who are eligible pursuant to Article V to be granted Incentive Stock Options under the Plan.

2.16 “Exchange Act” means the Securities Exchange Act of 1934, as amended. Any references to any section of the Exchange Act shall also be a reference to any successor provision.

2.17 “Fair Market Value”means, for purposes of the Plan, unless otherwise required by any applicable provision of the Code or any regulations issued thereunder, as of any date and except as provided below, the average of the high and low sales prices reported for the Common Stock on the applicable date: (a) as reported on the principal national securities exchange in the United States on which it is then traded; or (b) if not traded on any such national securities exchange, as quoted on an automated quotation system sponsored by the Financial Industry Regulatory Authority. For purposes of the grant of any Award, the applicable date shall be the date on which the Award is granted, or if the Common Stock shall not have been reported or quoted on such date, on the first day prior thereto on which the Common Stock was reported or quoted. For purposes of the exercise of any Award, the applicable date shall be the date a notice of exercise is received by the Committee or, if not a day on which the applicable market is open, the next day that it is open.

2.18 “Family Member” means “family member” as defined in Section A.1.(a)(5) of the general instructions of Form S-8.

2.19 “409A Covered Award” has the meaning set forth in Section 13.13(b).

2.20 “Good Reason” means, with respect to a Participant’s Termination of Employment, the following: (a) in the case where there is an employment agreement, change in control agreement or similar agreement in effect between the Company or an Affiliate and the Participant at the time of the grant of the Award that defines “good reason” (or words or a concept of like import), a termination due to good reason (or words or a concept of like import), as defined in such agreement at the time of the grant of the Award; provided, however, that with regard to any agreement under which the definition of “good reason” applies only on occurrence of a change in control (including, without limitation, a Change in Control), such definition of “good reason” shall not apply until a change in control (including, without limitation, a Change in Control) actually takes place and then only with regard to a termination thereafter; or (b) if such an agreement does not exist or if “good reason” is not defined in any such agreement, as defined in the Award agreement, if at all.

2.21 “Incentive Stock Option” means any Option awarded to an Eligible Employee under the Plan intended to be and designated as an “Incentive Stock Option” within the meaning of Section 422 of the Code.

2.22 “Non-Employee Director” means a Director of the Company who is not an active employee of the Company or an Affiliate.

2.23 “Non-Tandem Stock Appreciation Right” shall mean the right to receive an amount in cash and/or stock equal to the difference between (x) the Fair Market Value of a share of Common Stock on the date such right is exercised, and (y) the aggregate exercise price of such right, otherwise than on surrender of an Option.

2.24 “Option” means any option to purchase shares of Common Stock granted to Eligible Employees, Non-Employee Directors or Consultants pursuant to Article VI.

2.25 “Other Stock-Based Award” means an Award under Article X of the Plan that is valued in whole or in part by reference to, or is payable in or otherwise based on, Common Stock.

2.26 “Parent” means any parent corporation of the Company within the meaning of Section 424(e) of the Code.

2.27 “Participant” means an Eligible Employee, Non-Employee Director or Consultant to whom an Award has been granted pursuant to the Plan.

2.28 “Performance Award” means an Award made pursuant to Article IX of the Plan of the right to receive Common Stock or cash at the end of a specified Performance Period.

2.29 “Performance Period” has the meaning set forth in Section 9.1.

2.30 “Person” means any individual, corporation, partnership, limited liability company, firm, joint venture, association, joint-stock company, trust, incorporated organization, governmental or regulatory or other entity.

2.31 “Plan” means this Bed Bath & Beyond Inc. 2018 Incentive Compensation Plan, as amended from time to time.

2.32 “Prior Plan” means the Bed Bath & Beyond Inc. 2012 Incentive Compensation Plan, as amended.

2.33 “Reference Stock Option” has the meaning set forth in Section 7.1.

2.34 “Restricted Stock Award” means an Award of shares of Common Stock, or the right to receive shares of Common Stock in the future, subject to the restrictions under Article VIII.

2.35 “Restricted Stock Unit” means an Award of a bookkeeping entry representing an amount equal to the Fair Market Value of one share of Common Stock. Each Restricted Stock Unit represents an unfunded and unsecured obligation of the Company, which may be paid in cash, shares of Common Stock or a combination thereof, as provided in an Award agreement.

2.36 “Restriction Period” has the meaning set forth in Subsection 8.3(a) with respect to Restricted Stock Awards.

2.37 “Retirement” means a voluntary Termination of Employment or Termination of Consultancy at or after age 65 or such earlier date as may be determined by the Committee at the time of grant or thereafter. For the avoidance of doubt, Retirement shall not include a Termination of Employment or Termination of Consultancy without Cause or due to death or Disability. With respect to a Participant’s Termination of Directorship, Retirement means the failure to stand for reelection or the failure to be reelected on or after a Participant has attained age 65.

2.38 “Rule 16b-3” means Rule 16b-3 under Section 16(b) of the Exchange Act as then in effect or any successor provision.

2.39 “Securities Act” means the Securities Act of 1933, as amended, and all rules and regulations promulgated thereunder. Any reference to any section of the Securities Act shall also be a reference to any successor provision.

2.40 “Stock Appreciation Right” shall mean the right pursuant to an Award granted under Article VII.

2.41 “Subsidiary” means any subsidiary corporation of the Company within the meaning of Section 424(f) of the Code.

2.42 “Substitute Awards” mean Awards granted or shares of Common Stock issued by the Company in assumption of, or in substitution or exchange for, awards previously granted, by a company acquired by the Company or an Affiliate or with which the Company or an Affiliate combines.

2.43 “Tandem Stock Appreciation Right” means the right to surrender to the Company all (or a portion) of an Option in exchange for an amount in cash and/or stock equal to the difference between (i) the Fair Market Value, on the date such Option (or such portion thereof) is surrendered, of the Common Stock covered by such Option (or such portion thereof), and (ii) the aggregate exercise price of such Option (or such portion thereof).

2.44 “Ten Percent Shareholder” means a person owning stock possessing more than 10% of the total combined voting power of all classes of stock of the Company, its Subsidiaries or its Parents, if any.

2.45 “Termination” means a Termination of Consultancy, Termination of Directorship or Termination of Employment, as applicable.

2.46 “Termination of Consultancy” means: (a) that the Consultant is no longer acting as a consultant to the Company or an Affiliate; or (b) when an entity retaining a Participant as a Consultant ceases to be an Affiliate, unless the Participant otherwise is, or thereupon becomes, a Consultant to the Company or another Affiliate at the time the entity ceases to be an Affiliate. In the event that a Consultant becomes an Eligible Employee or a Non-Employee Director upon the termination of his or her

consultancy, unless otherwise determined by the Committee, in its sole discretion, no Termination of Consultancy shall be deemed to occur until such time as such Consultant is no longer any of a Consultant, an Eligible Employee or a Non-Employee Director. Notwithstanding the foregoing, the Committee may otherwise define Termination of Consultancy in the Award agreement or, if no rights of a Participant are reduced, may otherwise define Termination of Consultancy thereafter.

2.47 “Termination of Directorship” means that the Non-Employee Director has ceased to be a Director of the Company; except that if a Non-Employee Director becomes an Eligible Employee or a Consultant upon the termination of his or her directorship, his or her ceasing to be a Director of the Company shall not be treated as a Termination of Directorship unless and until the Participant has a Termination of Employment or Termination of Consultancy, as the case may be.

2.48 “Termination of Employment” means: (a) a termination of employment (for reasons other than a military or personal leave of absence granted by the Company) of a Participant from the Company and its Affiliates; or (b) when an entity employing a Participant ceases to be an Affiliate, unless the Participant otherwise is, or thereupon becomes, employed by the Company or another Affiliate at the time the entity ceases to be an Affiliate. In the event that an Eligible Employee becomes a Consultant or a Non-Employee Director upon the termination of his or her employment, unless otherwise determined by the Committee, in its sole discretion, no Termination of Employment shall be deemed to occur until such time as such Eligible Employee is no longer any of an Eligible Employee, a Consultant or a Non-Employee Director. Notwithstanding the foregoing, the Committee may otherwise define Termination of Employment in the Award agreement or, if no rights of a Participant are reduced, may otherwise define Termination of Employment thereafter.

2.49 “Transfer” means: (a) when used as a noun, any direct or indirect transfer, sale, assignment, pledge, hypothecation, encumbrance or other disposition (including the issuance of equity in a Person), whether for value or no value and whether voluntary or involuntary (including by operation of law), and (b) when used as a verb, to directly or indirectly transfer, sell, assign, pledge, encumber, charge, hypothecate or otherwise dispose of (including by the issuance of equity in a Person) whether for value or for no value and whether voluntarily or involuntarily (including by operation of law). “Transferred” and “Transferable” shall have a correlative meaning.

ARTICLE III

ADMINISTRATION

3.1The Committee. The Plan shall be administered and interpreted by the Committee. Notwithstanding anything herein to the contrary, the Board shall have authority for administration and interpretation of the Plan with respect to Non-Employee Directors and all references herein to the authority of the Committee as applied to Non-Employee Directors shall be deemed to refer to the Board.

3.2Grants of Awards. The Committee shall have full authority to grant, pursuant to the terms of the Plan, to Eligible Employees, Consultants and Non-Employee Directors: (i) Options, (ii) Stock Appreciation Rights, (iii) Restricted Stock Awards, (iv) Performance Awards, and (v) Other Stock-Based Awards. Without limiting the generality of the foregoing, the Committee shall have the authority:

(a) to select the Eligible Employees, Consultants and Non-Employee Directors to whom Awards may from time to time be granted hereunder, provided that no award may be made to any Non-Employee Director unless all similarly situated Non-Employee Directors have the right to receive the same award on the same terms;

(b) to determine whether and to what extent Awards, or any combination thereof, are to be granted hereunder to one or more Eligible Employees, Consultants or Non-Employee Directors;

(c) to determine the number of shares of Common Stock (if any) to be covered by an Award granted hereunder;

(d) to determine the terms and conditions, not inconsistent with the terms of the Plan, of any Award granted hereunder (including, but not limited to, the exercise or purchase price (if any), any restriction or limitation, any vesting schedule or acceleration thereof, or any forfeiture restrictions or waiver thereof, regarding any Award and the shares of Common Stock relating thereto, based on such factors, if any, as the Committee shall determine, in its sole discretion);

(e) to determine whether, to what extent and under what circumstances grants of Options and other Awards under the Plan are to operate on a tandem basis and/or in conjunction with or apart from other awards made by the Company outside of the Plan;

(f) to determine whether and under what circumstances an Option may be settled in cash, Common Stock and/or restricted stock under Section 6.2(d);

(g) to determine whether, to what extent and under what circumstances Common Stock and other amounts payable with respect to an Award under the Plan shall be deferred either automatically or at the election of the Participant, provided, however, that any amounts so deferred shall be structured in a manner intended to comply with Section 409A of the Code;

(h) to determine whether to require a Participant, as a condition of the granting of any Award, to not sell or otherwise dispose of shares acquired pursuant to the exercise of an Award for a period of time as determined by the Committee, in its sole discretion, following the date of the acquisition of such Award;

(i) to modify, extend or renew an Award, subject to Sections 6.2(j) and 11.1 herein;

(j) to determine whether an Option is an Incentive Stock Option;

(k) solely to the extent permitted by applicable law, to determine whether, to what extent and under what circumstances to provide loans (which shall be on a recourse basis and shall bear interest at the rate the Committee shall provide) to Participants in order to purchase shares of Common Stock under the Plan; and

(l) to determine at grant that an Option shall cease to be exercisable or an Award shall be forfeited, or that proceeds or profits applicable to an Award shall be returned to the Company, in the event the Participant engages in detrimental activity with respect to the Company or its Affiliates (as such term is defined by the Committee in the Award agreement) and, to interpret such definition and to approve waivers with regard thereto.

3.3Guidelines. Subject to Article XI hereof, the Committee shall have the authority to adopt, alter and repeal such administrative rules, guidelines and practices governing the Plan and perform all acts, including the delegation of its responsibilities (to the extent permitted by applicable law and applicable stock exchange rules), as it shall, from time to time, deem advisable; to construe and interpret the terms and provisions of the Plan and any Award issued under the Plan (and any agreements relating thereto); and to otherwise supervise the administration of the Plan. The Committee may correct any defect, supply any omission or reconcile any inconsistency in the Plan or in any agreement relating thereto in the manner and to the extent it shall deem necessary to effectuate the purpose and intent of the Plan. Notwithstanding the foregoing, no action of the Committee under this Section 3.3 shall reduce the rights of any Participant without the Participant’s consent. To the extent applicable, the Plan is intended to comply with the applicable requirements of Rule 16b-3, and the Plan shall be limited, construed and interpreted in a manner so as to comply therewith.

Without limiting the generality of the foregoing, the Committee may adopt special guidelines, provisions and procedures applicable to Awards granted to persons who are residing in or employed in, or subject to, the taxes or laws of, any domestic or foreign jurisdictions to comply with, or to accommodate differences in, applicable laws, regulations, or accounting, listing or other rules with respect to such domestic or foreign jurisdictions.

3.4Decisions Final. Any decision, interpretation or other action made or taken in good faith by or at the direction of the Company, the Board or the Committee (or any of its members) arising out of or in connection with the Plan shall be within the absolute discretion of all and each of them, as the case may be, and shall be final, binding and conclusive on the Company and all employees and Participants and their respective heirs, executors, administrators, successors and assigns.

3.5Procedures. The Board may designate one of the members of the Committee as chairman and the Committee shall hold meetings, subject to the By-Laws of the Company, at such times and places as it shall deem advisable, including, without limitation, by telephone conference or written consent to the extent permitted by applicable law. A majority of the Committee members shall constitute a quorum. All determinations of the Committee shall be made by a majority of its members. Any decision or determination reduced to writing and signed by all the Committee members in accordance with the By-Laws of the Company shall be fully effective as if it had been made by a vote at a meeting duly called and held. The Committee shall make such rules and regulations for the conduct of its business as it shall deem advisable.

3.6Designation of Consultants/Liability.

(a) The Committee may designate employees of the Company and professional advisors to assist the Committee in the administration of the Plan and (to the extent permitted by applicable law and applicable exchange rules) may grant authority to officers to grant Awards and/or execute agreements or other documents on behalf of the Committee.

(b) The Committee may employ such legal counsel, consultants and agents as it may deem desirable for the administration of the Plan and may rely upon any opinion received from any such counsel or consultant and any computation received from any such consultant or agent. Expenses incurred by the Committee or the Board in the engagement of any such counsel, consultant or agent shall be paid by the Company. The Committee, its members and any person designated pursuant to sub-section (a) above shall not be liable for any action or determination made in good faith with respect to the Plan. To the maximum extent permitted by applicable law, no officer of the Company or member or former member of the Committee or of the Board shall be liable for any action or determination made in good faith with respect to the Plan or any Award granted under it.

3.7Indemnification. To the maximum extent permitted by applicable law and the Certificate of Incorporation and By-Laws of the Company and to the extent not covered by insurance directly insuring such person, each officer and member or former

member of the Committee or the Board shall be indemnified and held harmless by the Company against any cost or expense (including reasonable fees of counsel reasonably acceptable to the Committee) or liability (including any sum paid in settlement of a claim with the approval of the Committee), and advanced amounts necessary to pay the foregoing at the earliest time and to the fullest extent permitted, arising out of any act or omission to act in connection with the administration of the Plan, except to the extent arising out of such officer’s, member’s or former member’s own fraud or bad faith. Such indemnification shall be in addition to any rights of indemnification the employees, officers, Directors or members or former officers, Directors or members may have under applicable law or under the Certificate of Incorporation or By-Laws of the Company or any Affiliate or any agreement of indemnification. Notwithstanding anything else herein, this indemnification will not apply to the actions or determinations made by an individual with regard to Awards granted to him or her under the Plan.

ARTICLE IV

SHARE LIMITATION

4.1Shares.

(a)Aggregate Limitation. The following provisions apply in determining the aggregate number of shares of Common Stock available under the Plan.

(i) The aggregate number of shares of Common Stock that may be issued or used for reference purposes or with respect to which Awards may be granted under the Plan shall not exceed a total of 4,600,000, subject to any increase or decrease pursuant to Section 4.2, which may be either authorized and unissued Common Stock or Common Stock held in or acquired for the treasury of the Company or both. Any shares of Common Stock that are subject to Awards of Options or Stock Appreciation Rights shall be counted against this limit as one share for every share granted. Any shares of Common Stock that are subject to Awards other than Options or Stock Appreciation Rights shall be counted against this limit as 2.2 shares for every share granted.

(ii) If any Option or Stock Appreciation Right granted under the Plan expires, terminates or is canceled for any reason without having been exercised in full, the number of shares of Common Stock underlying such unexercised Award shall again be available for the purpose of Awards under the Plan. If any Awards under the Plan (other than Options or Stock Appreciation Rights) are forfeited for any reason, the number of forfeited shares of Common Stock shall again be available for the purposes of Awards under the Plan, subject to Section 4.1(a)(iv). If a Stock Appreciation Right is granted in tandem with an Option, such grant shall apply only once against the maximum number of shares of Common Stock that may be issued under the Plan. Shares of Common Stock underlying Awards that may be settled solely in cash shall not be deemed to use shares that may be issued under the Plan.

(iii) If Common Stock has been delivered or exchanged as full or partial payment to the Company for payment of purchase price of an Award under the Plan other than an Option or Stock Appreciation Right, or for payment of withholding taxes with respect to an Award under the Plan other than an Option or Stock Appreciation Right, the number of shares of Common Stock delivered or exchanged as payment of purchase price or for withholding shall be available again for the grant of Awards under the Plan. In addition, the number of shares of Common Stock available for the purpose of Awards under this Plan shall be reduced by (i) the total number of Options or Stock Appreciation Rights exercised, regardless of whether any of the shares of Common Stock underlying such Awards are not actually issued to the Participant as the result of a net settlement, and (ii) any shares of Common Stock used to pay any exercise price or tax withholding obligation with respect to any Option or Stock Appreciation Right. In addition, the Company may not use the cash proceeds it receives from Option exercises to repurchase shares of Common Stock on the open market for reuse under this Plan.

(iv) Any shares of Common Stock that again become available for grant pursuant to this Section 4.1(a) shall be added back as one share if such share were subject to an Option or Stock Appreciation Right granted under the Plan, as 2.2 shares if such shares were subject to an Award other than an Option or a Stock Appreciation Right granted under the Plan as provided in Section 4.1(a)(i).

(b)Individual Participant Limitations. The following provisions apply in determining the Awards that may be granted to an individual during a fiscal year of the Company.

(i) The maximum number of shares of Common Stock subject to Options and/or Stock Appreciation Rights that may be granted under the Plan during any fiscal year of the Company to an Eligible Employee shall be, in the aggregate, 1,000,000 shares (subject to any increase or decrease pursuant to Section 4.2). The maximum number of shares of Common Stock subject to Restricted Stock Awards and/or Other Stock-Based Awards that may be granted under the Plan during any fiscal year of the Company to an Eligible Employee shall be, in the aggregate, 750,000 shares, (subject to any increase or decrease pursuant to Section 4.2). The maximum number of shares of Common Stock subject to Performance

Awards denominated in shares of Common Stock that may be granted to an Eligible Employee under the Plan attributable to any year of a Performance Period shall be 750,000 shares (subject to any increase or decrease pursuant to Section 4.2). If a Stock Appreciation Right is granted in tandem with an Option it shall apply against the Eligible Employee’s individual share limitation applicable to Stock Appreciation Rights and Options.

(ii) The maximum payment that may be made to an Eligible Employee under Performance Awards granted under the Plan and denominated in dollars attributable to any year of a Performance Period shall be $5,000,000.

(iii) Notwithstanding any other provision of the Plan to the contrary, the aggregate value of equity-based Awards granted to a Non-Employee Director in respect of any fiscal year of the Company, plus any cash-based compensation granted to a Non-Employee Director under the Plan or otherwise in respect of any fiscal year of the Company (whether paid in cash or common stock or on a current or deferred basis), in each case, solely with respect to the individual’s service as a Non-Employee Director, may not exceed $700,000 based on the aggregate Fair Market Value (determined as of the date of grant) of any equity-based Award plus the aggregate value (determined as of the date of grant) of any cash-based compensation.

(iv) Notwithstanding the foregoing, to the extent that shares of Common Stock or amounts for which Awards are permitted to be granted to an Eligible Employee or a Non-Employee Director pursuant to Section 4.1(b) during a fiscal year of the Company or Performance Period, as the case may be, are not covered by an Award in the Company’s fiscal year or Performance Period, as the case may be, such shares of Common Stock or amounts shall be available for grant or issuance to such Eligible Employee or Non-Employee Director in any subsequent fiscal year or years during the term of the Plan.

(c)Substitute Awards. Substitute Awards shall not reduce the shares of Common Stock authorized for grant under the Plan pursuant to Section 4.1(a) or authorized for grant to an Eligible Employee or Non-Employee Director in any fiscal year of the Company pursuant to Section 4.1(b). Additionally, in the event that a company acquired by the Company or an Affiliate, or with which the Company or an Affiliate combines, has shares available under a pre-existing plan approved by shareholders and not adopted in contemplation of such acquisition or combination, the shares available for grant pursuant to the terms of such pre-existing plan (as adjusted, to the extent appropriate, using the exchange ratio or other adjustment or valuation ratio or formula used in such acquisition or combination to determine the consideration payable to the holders of common stock of the entities party to such acquisition or combination) may be used for Awards under the Plan and shall not reduce the shares of Common Stock authorized for grant under the Plan; provided that Awards using such available shares shall not be made after the date awards or grants could have been made under the terms of the pre-existing plan, absent the acquisition or combination, and shall be made only to individuals who were not Eligible Employees, Consultants or Non-Employee Directors prior to such acquisition or combination.

4.2Changes.

(a) The existence of the Plan and the Awards granted hereunder shall not affect in any way the right or power of the Board or the shareholders of the Company to make or authorize (i) any adjustment, recapitalization, reorganization or other change in the Company’s capital structure or its business, (ii) any merger or consolidation of the Company or any Affiliate, (iii) any issuance of bonds, debentures, preferred or prior preference stock ahead of or affecting the Common Stock, (iv) the dissolution or liquidation of the Company or any Affiliate, (v) any sale or transfer of all or part of the assets or business of the Company or any Affiliate or (vi) any other corporate act or proceeding.

(b) Subject to the provisions of Section 4.2(d), in the event of any such change in the capital structure or business of the Company by reason of any stock split, reverse stock split, stock dividend or distribution, combination or reclassification of shares, recapitalization, merger, consolidation, spin-off, reorganization, partial or complete liquidation, issuance of rights or warrants to purchase any Common Stock or securities convertible into Common Stock, any sale or transfer of all or part of the Company’s assets or business, any special cash dividend or any other corporate transaction or event having an effect similar to any of the foregoing and effected without receipt of consideration by the Company and the Committee determines in good faith that an adjustment is necessary or appropriate under the Plan to prevent substantial dilution or enlargement of the rights granted to, or available for, Participants under the Plan, then the aggregate number and kind of shares that thereafter may be issued under the Plan, the number and kind of shares or other property (including cash) to be issued upon exercise of an outstanding Award or under other Awards granted under the Plan and the purchase price thereof shall be appropriately adjusted consistent with such change in such manner as the Committee may deem equitable to prevent substantial dilution or enlargement of the rights granted to, or available for, Participants under the Plan, and any such adjustment determined by the Committee in good faith shall be final, binding and conclusive on the Company and all Participants and employees and their respective heirs, executors, administrators, successors and assigns. In connection with any event described in this paragraph, the Committee may provide, in its sole discretion, for the cancellation of any outstanding Awards and payment in cash or other property in exchange therefor. In furtherance of this Section 4.2(b), each outstanding Award shall be adjusted as provided

herein in the event of an “equity restructuring” within the meaning of FASB ASC Topic 718. Except as provided in this Section 4.2 or in the applicable Award agreement, a Participant shall have no rights by reason of any issuance by the Company of any class or securities convertible into stock of any class, any subdivision or consolidation of shares of stock of any class, the payment of any stock dividend, any other increase or decrease in the number of shares of stock of any class, any sale or transfer of all or part of the Company’s assets or business or any other change affecting the Company’s capital structure or business.

(c) Unless otherwise determined by the Committee, fractional shares of Common Stock resulting from any adjustment in Awards pursuant to Section 4.2(a) or (b) shall be aggregated until, and eliminated at, the time of exercise by rounding-down for fractions that are less than one-half and rounding-up for fractions that are equal to or greater than one-half. Notice of any adjustment shall be given by the Committee to each Participant whose Award has been adjusted and such adjustment (whether or not such notice is given) shall be effective and binding for all purposes of the Plan.

(d) In the event of (x) a merger or consolidation in which the Company is not the surviving entity, (y) any transaction that results in the acquisition of substantially all of the Company’s outstanding Common Stock by a single person or entity or by a group of persons and/or entities acting in concert, or (z) the sale or transfer of all or substantially all of the Company’s assets (all of the foregoing being referred to as an “Acquisition Event”), then provided that a successor does not assume or substitute outstanding Awards on a substantially equivalent basis as provided in Section 4.3, the Committee, in its sole discretion, may terminate all vested and unvested Awards that are outstanding as of the date of the Acquisition Event and (i) with respect to Awards other than Options and Stock Appreciation Rights, make payment to the Participant for such Award (whether vested and unvested) following such Acquisition Event and (ii) with respect to Options and Stock Appreciation Rights, deliver notice of termination to each Participant at least 20 days prior to the date of the Acquisition Event, in which case, during the period from the date on which such notice of termination is delivered to the date of the Acquisition Event, each such Participant shall have the right to exercise in full all of his or her vested and unvested Awards that are then outstanding (without regard to any limitations on vesting or exercisability otherwise contained in the Award agreements), but any such exercise shall be contingent on the consummation of the Acquisition Event, and, provided that, if the Acquisition Event does not occur within a specified period after giving such notice for any reason whatsoever, the notice and exercise pursuant thereto shall be null and void.

If an Acquisition Event occurs but the Committee does not terminate the outstanding Awards pursuant to this Section 4.2(d), then the provisions of Section 4.2(b) shall apply.

4.3Change in Control. In the event of a Change in Control, each outstanding Award will be treated as the Committee determines, in its sole discretion without a Participant’s consent, as follows:

(a) Awards will be assumed or substituted on a substantially equivalent basis by the acquiring or succeeding entity (or an affiliate thereof) (each a “successor”) with appropriate adjustments in accordance with Section 4.2(b) as to the number and kind of shares and prices;

(i) upon written notice to a Participant, Awards will terminate upon or immediately prior to the consummation of such Change in Control, subject to the terms and conditions of Section 4.3(b), provided that the successor does not assume or substitute substantially equivalent Awards;

(ii) outstanding Awards will vest and become exercisable, realizable, or payable or restrictions applicable to an Award will lapse, in whole or in part, subject to the terms and conditions of Section 4.3(b), provided that the successor does not assume or substitute substantially equivalent Awards, or, in the event of any such assumption or substitution, solely upon the termination of a Participant’s employment by the Company, an Affiliate or successor without Cause or by the Participant for Good Reason, in each case, in connection with a Change in Control, as specified in a plan established by the Company, an Affiliate or successor, a written agreement between the Participant and the Company, Affiliate or successor or as otherwise determined by the Committee;

(iii) (A) the termination of an Award in exchange for an amount of cash and/or property, if any, equal to the amount that would have been attained upon the exercise of such Award or realization of the Participant’s rights as of the date of the occurrence of the Change in Control, subject to the terms and conditions of Section 4.3(b), provided that the successor does not assume or substitute substantially equivalent Awards (and, for the avoidance of doubt, if as of the date of the occurrence of the Change in Control the Committee determines in good faith that no amount would have been attained upon the exercise of such Award or realization of the Participant’s rights, then such Award may be terminated by the Company without payment), or (B) the replacement of such Award on a substantially equivalent basis with other rights or property selected by the Committee in its sole discretion; or

(iv) any combination of the foregoing.

In taking any of the actions permitted under this Section 4.3, the Committee will not be obligated to treat all Awards, all Awards held by a Participant, or all Awards of the same type, similarly.

(b) In the event that the successor does not assume or substitute for the Award (or portion thereof) on a substantially equivalent basis, immediately prior to the Change in Control (but conditioned on the consummation of the Change in Control), the Participant will fully vest in and have the right to exercise all of his or her outstanding Options and Stock Appreciation Rights that are not assumed or substituted, including shares of Common Stock as to which such Awards would not otherwise be vested or exercisable, all restrictions on Restricted Stock, Performance Awards, and Other Stock-Based Awards (including, without limitation, Restricted Stock Units) not assumed or substituted for will lapse, and, with respect to Awards with performance-based vesting not assumed or substituted, all performance goals or other vesting criteria will be deemed achieved at the greater of actual achievement of the performance goals or one hundred percent (100%) of target levels, pro-rated on the basis of service through the date of the Change in Control, and all other terms and conditions will be deemed met. In addition, if an Option or Stock Appreciation Right is not assumed or substituted in the event of a Change in Control, the Committee will notify the Participant in writing or electronically that the Option or Stock Appreciation Right will be fully vested and exercisable for a period of time determined by the Committee in its sole discretion (but in no event for a period of less than ten business days), and the Option or Stock Appreciation Right will terminate upon the expiration of such period.

(c) For the purposes of this Section 4.3, an Award will be considered assumed or substituted on a substantially equivalent basis if, following the Change in Control, the Award vests and, if applicable, becomes exercisable, in accordance with its original terms and confers the right to purchase or receive, for each share of Common Stock subject to the Award immediately prior to the Change in Control, the consideration (whether stock, cash, or other securities or property) received in the Change in Control by holders of Common Stock for each Share held on the effective date of the transaction (and if holders were offered a choice of consideration, the type of consideration chosen by the holders of a majority of the outstanding shares of Common Stock) (less the applicable exercise price in the case of an Option or Stock Appreciation Right); provided, however, that if such consideration received in the Change in Control does not consist solely of common stock of the successor or its Parent, the Committee may, with the consent of the successor, provide for the per share consideration to be received upon the exercise of an Option or Stock Appreciation Right or upon the payout of Restricted Stock, Performance Award, or Other Stock Based Award for each share of Common Stock subject to such Award to consist solely of common stock of the successor or its Parent equal in fair market value to the per share consideration received by holders of Common Stock in the Change in Control.

(d) Notwithstanding anything in this Section 4.3 to the contrary, an Award that vests, is earned, or paid-out upon the satisfaction of one or more performance goals will not be considered assumed if the Company or its successor modifies any of such performance goals without the Participant’s consent; provided, however, a good faith modification to such performance goals only to reflect the successor’s post-Change in Control corporate structure will not be deemed to invalidate an otherwise valid Award assumption.

4.4Minimum Purchase Price. Notwithstanding any provision of the Plan to the contrary, if authorized but previously unissued shares of Common Stock are issued under the Plan, such shares shall not be issued for a consideration that is less than as permitted under applicable law.

ARTICLE V

ELIGIBILITY

5.1General Eligibility. All Eligible Employees, Consultants and Non-Employee Directors are eligible to be granted Awards. Eligibility for the grant of Awards and actual participation in the Plan shall be determined by the Committee in its sole discretion. Notwithstanding anything herein to the contrary, no Option under which a Participant may receive Common Stock may be granted under the Plan to an Eligible Employee, Consultant or Non-Employee Director if such stock does not constitute “service recipient stock” for purposes of Section 409A of the Code with respect to such Eligible Employee, Consultant or Non-Employee Director, unless such Option is structured in a manner intended to comply with, or be exempt from, Section 409A of the Code.

5.2Incentive Stock Options. Only employees of the Company or its Subsidiaries, other than prospective employees, shall be eligible for grants of Incentive Stock Options under the Plan. Eligibility for the grant of an Incentive Stock Option and actual participation in the Plan shall be determined by the Committee in its sole discretion.

5.3General Requirement. The vesting and exercise of Awards granted to a prospective employee or consultant shall be conditioned upon such individual actually becoming an employee of or consultant to the Company or an Affiliate within a reasonable time thereafter, as determined by the Committee.

ARTICLE VI

STOCK OPTIONS

6.1Options. Options may be granted alone or in addition to other Awards granted under the Plan. The Committee shall have the authority to grant any Eligible Employee, Consultant or Non-Employee Director one or more Options. Each Option granted under the Plan shall be one of two types: (i) an Incentive Stock Option intended to satisfy the requirements of Section 422 of the Code; or (ii) a non-qualified Option, not intended to be an Incentive Stock Option within the meaning of Section 422 of the Code.

6.2Terms of Options. Options granted under the Plan shall be subject to the following terms and conditions and shall be in such form and contain such additional terms and conditions, not inconsistent with the terms of the Plan, as the Committee shall deem desirable:

(a)Exercise Price. The exercise price per share of Common Stock subject to an Option shall be determined by the Committee at the time of grant, provided that the per-share exercise price of any Option shall not be less than 100% of the Fair Market Value of the Common Stock at the time of grant; provided, however, that if an Incentive Stock Option is granted to a Ten Percent Shareholder, the per share exercise price of any such Option shall be no less than 110% of the Fair Market Value of the Common Stock at the time of grant.

(b)Option Term. The term of each Option shall be fixed by the Committee, provided that no Option shall be exercisable more than eight years after the date the Option is granted; and provided further that the term of an Incentive Stock Option granted to a Ten Percent Shareholder shall not exceed five years after the date the Option is granted.

(c)Exercisability. Unless the Committee determines otherwise at grant or as otherwise provided herein, Options shall be exercisable at such time or times and subject to such terms and conditions as shall be determined by the Committee at grant. Notwithstanding the foregoing, if the Committee provides, in its discretion, that any Option is exercisable subject to certain limitations (including, without limitation, that such Option is exercisable only in installments or within certain time periods), the Committee may waive such limitations on the exercisability at any time at or after grant in whole or in part (including, without limitation, waiver of the installment exercise provisions or acceleration of the time at which such Option may be exercised), based on such factors, if any, as the Committee shall determine, in its sole discretion. Notwithstanding anything herein to the contrary, the schedule according to which any Option shall vest shall be no less than (i) one year, if the vesting terms and conditions are based (in whole or in part) on the attainment of one or more objective performance goals, including, to the extent the Committee so determines, from among those set forth in Exhibit A and (ii) three years, if the vesting terms and conditions are based solely on the continued performance of services by the Participant (with no more than one third of the shares of Common Stock subject thereto vesting on each of the first three anniversaries of the date of grant); provided, that, subject to the terms of the Plan, the Committee shall be authorized (at the time of grant or thereafter) to provide for the acceleration of vesting in the event of a change in control (including, without limitation, a Change in Control ) (subject to Section 4.3 and provided that a successor does not assume or substitute outstanding awards on a substantially equivalent basis) or a Participant’s retirement (including, without limitation, Retirement), death or Disability; and provided further, that, subject to the limitations set forth in Section 4.1(a)(i), Options with respect to up to 5% of the total number of shares of Common Stock reserved for Awards under the Plan may be granted that are not subject to the foregoing limitations.

(d)Method of Exercise. Subject to whatever installment exercise and waiting period provisions apply under subsection (c) above, to the extent vested, Options may be exercised in whole or in part at any time during the Option term, by giving written notice of exercise to the Company specifying the number of shares of Common Stock to be purchased. Such notice shall be accompanied by payment in full of the purchase price (or arrangements satisfactory to the Committee made for such payment) as follows: (i) in cash or by check, bank draft or money order payable to the order of the Company; (ii) solely to the extent permitted by applicable law, if the Common Stock is traded on a national securities exchange or quoted on a national quotation system sponsored by the Financial Industry Regulatory Authority, and the Committee authorizes, through a procedure whereby the Participant delivers irrevocable instructions to a broker reasonably acceptable to the Committee to deliver promptly to the Company an amount equal to the purchase price; or (iii) on such other terms and conditions as may be acceptable to the Committee (including, without limitation, the relinquishment of Options or by payment in full or in part in the form of Common Stock (including by attestation) owned by the Participant for such period, or acquired in such manner, as to avoid an incremental charge, for accounting purposes, against the Company’s earnings as reported in the Company’s financial statements (and for which the Participant has good title free and clear of any liens and encumbrances) based on the Fair Market Value of the Common Stock on the payment date as determined by the Committee). No shares of Common Stock shall be issued until payment therefor, as provided herein, has been made or provided for.

(e)Termination by Death, Disability or Retirement. Unless otherwise (x) provided in a written agreement between the Company and the Participant or (y) determined by the Committee at grant or (if no rights of the Participant are reduced)

thereafter, if a Participant’s Termination is by reason of death, Disability or Retirement, all Options that are held by such Participant that are vested and exercisable at the time of the Participant’s Termination may be exercised by the Participant (or, in the case of death, by the legal representative of the Participant’s estate) at any time within a period of one year from the date of such Termination, but in no event beyond the expiration of the stated term of such Options; provided, however, that in the case of Retirement, if the Participant dies within such exercise period, all unexercised Options held by such Participant shall thereafter be exercisable, to the extent to which they were exercisable at the time of death, for a period of one year from the date of such death, but in no event beyond the expiration of the stated term of such Options.

(f)Involuntary Termination Without Cause or for Good Reason. Unless otherwise (x) provided in a written agreement between the Company and the Participant or (y) determined by the Committee at grant, or (if no rights of the Participant are reduced) thereafter, if a Participant’s Termination is by involuntary termination without Cause or, to the extent applicable, Good Reason, all Options that are held by such Participant that are vested and exercisable at the time of the Participant’s Termination may be exercised by the Participant at any time within a period of 90 days from the date of such Termination, but in no event beyond the expiration of the stated term of such Options.

(g)Voluntary Termination. Unless otherwise (x) provided in a written agreement between the Company and the Participant or (y) determined by the Committee at grant or (if no rights of the Participant are reduced) thereafter, if a Participant’s Termination is voluntary (other than a voluntary termination described in subsection (h) (ii) below or covered by (f) above), all Options held by such Participant that are vested and exercisable at the time of the Participant’s Termination may be exercised by the Participant at any time within a period of 90 days from the date of such Termination, but in no event beyond the expiration of the stated term of such Options.

(h)Termination for Cause. Unless otherwise (x) provided in a written agreement between the Company and the Participant or (y) determined by the Committee at grant or (if no rights of the Participant are reduced) thereafter, if a Participant’s Termination (i) is for Cause or (ii) is a voluntary Termination after the occurrence of an event that would be grounds for a Termination for Cause, all Options held by such Participant, whether or not vested, shall thereupon terminate and expire as of the date of such Termination.

(i)Unvested Options. Unless otherwise (x) provided in a written agreement between the Company and the Participant or (y) determined by the Committee at grant or (if no rights of the Participant are reduced) thereafter, Options that are not vested as of the date of a Participant’s Termination for any reason shall terminate and expire as of the date of such Termination.

(j)Form, Modification, Extension and Renewal of Options. Subject to the terms and conditions and within the limitations of the Plan, Options shall be evidenced by such form of agreement or grant as is approved by the Committee, and the Committee may (i) modify, extend or renew outstanding Options granted under the Plan (provided that the rights of a Participant are not reduced without his or her consent), and (ii) accept the surrender of outstanding Options (up to the extent not theretofore exercised) and authorize the granting of new Options in substitution therefor (to the extent not theretofore exercised). Notwithstanding the foregoing, an outstanding Option may not be modified to reduce the exercise price thereof nor may a new Option at a lower price be substituted for a surrendered Option (other than adjustments or substitutions in accordance with Section 4.2), unless such action is approved by the shareholders of the Company.

(k)Early Exercise. The Committee may provide that an Option include a provision whereby the Participant may elect at any time before the Participant’s Termination to exercise the Option as to any part or all of the shares of Common Stock subject to the Option prior to the full vesting of the Option and such shares shall be subject to the provisions of Article VIII and treated as restricted stock. Any unvested shares of Common Stock so purchased may be subject to a repurchase option in favor of the Company or to any other restriction the Committee determines to be appropriate.

(l)Incentive Stock Option Limitations. To the extent that the aggregate Fair Market Value (determined as of the time of grant) of the Common Stock with respect to which Incentive Stock Options are exercisable for the first time by an Eligible Employee during any calendar year under the Plan and/or any other stock option plan of the Company, any Subsidiary or any Parent exceeds $100,000, such Options shall be treated as non-qualified stock options. In addition, if an Eligible Employee does not remain employed by the Company or any Subsidiary at all times from the time an Incentive Stock Option is granted until three months prior to the date of exercise thereof (or such other period as required by applicable law), such Option shall be treated as a non-qualified stock option. Should any provision of the Plan not be necessary in order for the Options to qualify as Incentive Stock Options, or should any additional provisions be required, the Committee may amend the Plan accordingly, without the necessity of obtaining the approval of the shareholders of the Company.

(m)No Dividends or Dividend Equivalents. Until the shares of Common Stock are issued (as evidenced by the appropriate entry on the books of the Company or of a duly authorized transfer agent of the Company), no right to vote or receive dividends (except as provided in Section 4.2(b)) or any other rights as a shareholder will exist with respect to the shares of Common Stock subject to an Option, notwithstanding the exercise of the Option. Subject to the terms of the Plan, including,

without limitation, Section 13.5, the Company will issue (or cause to be issued) such shares of Common Stock promptly after the Option is exercised. No adjustment will be made for a dividend or other right for which the record date is prior to the date the shares of Common Stock are issued, except as provided in Section 4.2 of the Plan. No dividend equivalents shall be issued or paid with respect to any Option.

(n)Other Terms and Conditions. Options may contain such other provisions, which shall not be inconsistent with any of the terms of the Plan, as the Committee shall deem appropriate.

ARTICLE VII

STOCK APPRECIATION RIGHTS

7.1Tandem Stock Appreciation Rights. Tandem Stock Appreciation Rights shall be granted in conjunction with all or part of any Option (a “Reference Stock Option”) granted under the Plan. Each Tandem Stock Appreciation Right may be granted either at or after the time of the grant of its Reference Stock Option.

7.2Terms and Conditions of Tandem Stock Appreciation Rights. Tandem Stock Appreciation Rights granted hereunder shall be subject to such terms and conditions, not inconsistent with the provisions of the Plan, as shall be determined from time to time by the Committee, and the following:

(a)Exercise Price. The exercise price per share of Common Stock subject to a Tandem Stock Appreciation Right shall be the exercise price of the Reference Stock Option as determined in accordance with Section 6.2(a).

(b)Term. A Tandem Stock Appreciation Right or applicable portion thereof granted with respect to a Reference Stock Option shall terminate and no longer be exercisable upon the termination or exercise of the Reference Stock Option, except that, unless otherwise determined by the Committee, in its sole discretion, at the time of grant, a Tandem Stock Appreciation Right granted with respect to less than the full number of shares covered by the Reference Stock Option shall not be reduced until and then only to the extent the exercise or termination of the Reference Stock Option causes the number of shares covered by the Tandem Stock Appreciation Right to exceed the number of shares remaining available and unexercised under the Reference Stock Option.

(c)Exercisability. Tandem Stock Appreciation Rights shall be exercisable only at such time or times and to the extent that the Reference Stock Options to which they relate shall be exercisable in accordance with the provisions of Article VI, and shall be subject to the provisions of Section 6.2(c).

(d)Method of Exercise. A Tandem Stock Appreciation Right may be exercised by the Participant by surrendering the applicable portion of the Reference Stock Option. Upon such exercise and surrender, the Participant shall be entitled to receive an amount determined in the manner prescribed in this Section 7.2. Options that have been so surrendered, in whole or in part, shall no longer be exercisable to the extent the related Tandem Stock Appreciation Rights have been exercised.

(e)Payment. Upon the exercise of a Tandem Stock Appreciation Right, a Participant shall be entitled to receive up to, but no more than, an amount in cash and/or Common Stock (as chosen by the Committee in its sole discretion at the time of grant) equal in value to the excess of the Fair Market Value of one share of Common Stock over the Option exercise price per share specified in the Reference Stock Option agreement multiplied by the number of shares in respect of which the Tandem Stock Appreciation Right shall have been exercised.

(f)Deemed Exercise of Reference Stock Option. Upon the exercise of a Tandem Stock Appreciation Right for Common Stock, the Reference Stock Option (or part thereof, based on the value of the Common Stock issued on exercise) to which such Stock Appreciation Right is related shall be deemed to have been exercised for purposes of the limitation set forth in Article IV of the Plan on the number of shares of Common Stock to be issued under the Plan.

7.3Non-Tandem Stock Appreciation Rights. Non-Tandem Stock Appreciation Rights may also be granted without reference to any Options granted under the Plan.

7.4Terms and Conditions of Non-Tandem Stock Appreciation Rights. Non-Tandem Stock Appreciation Rights granted hereunder shall be subject to such terms and conditions, not inconsistent with the provisions of the Plan, as shall be determined from time to time by the Committee, and the following:

(a)Exercise Price. The exercise price per share of Common Stock subject to a Non-Tandem Stock Appreciation Right shall be determined by the Committee at the time of grant, provided that the per share exercise price of a Non-Tandem Stock Appreciation Right shall not be less than 100% of the Fair Market Value of the Common Stock at the time of grant.

(b)Term. The term of each Non-Tandem Stock Appreciation Right shall be fixed by the Committee, but shall not exceed eight years after the date the right is granted.

(c)Exercisability. Unless the Committee determines otherwise at grant or as otherwise provided herein, Non-Tandem Stock Appreciation Rights shall be exercisable at such time or times and subject to such terms and conditions as shall be determined by the Committee at grant. If the Committee provides, in its discretion, that any such right is exercisable subject to certain limitations (including, without limitation, that it is exercisable only in installments or within certain time periods), the Committee may waive such limitations on the exercisability at any time at or after grant in whole or in part (including, without limitation, waiver of the installment exercise provisions or acceleration of the time at which such right may be exercised), based on such factors, if any, as the Committee shall determine, in its sole discretion. Notwithstanding anything herein to the contrary, the schedule according to which any Non-Tandem Stock Appreciation Right shall vest shall be no less than (i) one year, if the vesting terms and conditions are based (in whole or in part) on the attainment of one or more objective performance goals, including, to the extent the Committee so determines, from among those set forth in Exhibit A and (ii) three years, if the vesting terms and conditions are based solely on the continued performance of services by the Participant (with no more than one third of the shares of Common Stock subject thereto vesting on each of the first three anniversaries of the date of grant); provided, that, subject to the terms of the Plan, the Committee shall be authorized (at the time of grant or thereafter) to provide for the acceleration of vesting in the event of a change in control (including, without limitation, a Change in Control) (subject to Section 4.3 and provided that a successor does not assume or substitute outstanding awards on a substantially equivalent basis) or a Participant’s retirement (including, without limitation, Retirement), death or Disability; and provided further, that, subject to the limitations set forth in Section 4.1(a), Options with respect to up to 5% of the total number of shares of Common Stock reserved for Awards under the Plan may be granted that are not subject to the foregoing limitations.

(d)Method of Exercise. Subject to the installment, exercise and waiting period provisions that apply under subsection (b) above, Non-Tandem Stock Appreciation Rights may be exercised in whole or in part at any time in accordance with the applicable Award agreement, by giving written notice of exercise to the Company specifying the number of Non-Tandem Stock Appreciation Rights to be exercised.

(e)Payment. Upon the exercise of a Non-Tandem Stock Appreciation Right, a Participant shall be entitled to receive, for each right exercised, an amount in cash and/or Common Stock (as chosen by the Committee in its sole discretion at the time of grant) no greater than the excess of the Fair Market Value of one share of Common Stock on the date the right is exercised over the Fair Market Value of one share of Common Stock on the date the right was awarded to the Participant.

7.5No Dividends or Dividend Equivalents. A Stock Appreciation Right does not confer upon a Participant the same rights as a shareholder, and therefore, no dividends will be issued or paid to a Participant with respect to such Stock Appreciation Right, except as provided in Section 4.2(b). No dividend equivalents shall be issued or paid with respect to any Stock Appreciation Right, except as provided in Section 4.2(b).

ARTICLE VIII

RESTRICTED STOCK AWARDS

8.1Restricted Stock Awards. Restricted Stock Awards may be issued either alone or in addition to other Awards granted under the Plan. The Committee shall determine the Eligible Employees, Consultants and Non-Employee Directors, to whom, and the time or times at which, grants of Restricted Stock Awards shall be made, the number of shares to be awarded, the price (if any) to be paid by the Participant (subject to Section 8.2), the time or times within which such Awards may be subject to forfeiture, the vesting schedule and rights to acceleration thereof, and all other terms and conditions of the Awards.

8.2Awards and Certificates. Eligible Employees, Consultants and Non-Employee Directors selected to receive a Restricted Stock Award shall not have any rights with respect to such Award, unless and until such Participant has delivered a fully executed copy of the agreement evidencing the Award to the Company or has otherwise complied with the applicable terms and conditions of such Award (including, without limitation, procedures or provisions regarding the deemed acceptance of such Award). Further, such Award shall be subject to the following conditions:

(a)Purchase Price. Unless (x) otherwise provided by the Committee or (y) prohibited by applicable law, the purchase price of a Restricted Stock Award shall be zero. If required by law or the Committee otherwise determines that a Restricted Stock Award shall have a purchase price, such purchase price shall not be less than par value.

(b)Acceptance. Restricted Stock Awards must be accepted within a period of 60 days (or such shorter period as the Committee may specify at grant) after the grant date, by executing an Award agreement or otherwise accepting such Award and by paying the price (if any) the Committee has designated thereunder.

8.3Restrictions and Conditions. Restricted Stock Awards awarded pursuant to the Plan shall be subject to the following restrictions and conditions:

(a)Restriction Period.